are hoa fees tax deductible in california

Are HOA fees tax-deductible. The IRS considers HOA fees as a rental expense which means you can write.

Is It Better To Rent Or Buy The New York Times

Deduct as a common business expense for your rental.

. Are HOA fees tax deductible. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. It provides for the rental business and expenses related to the basic upkeep of rental homes are business expenses.

If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. In the rules of business expense tax exemptions HOA fees count.

Before claiming your HOA fees you will have to determine how much space your home office takes up in your house. As a general rule no fees are not tax-deductible. Yes HOA fees are deductible for home offices.

If you use 10 of your home as an office the same percentage of HOA fees is. Say Thanks by clicking the thumb icon in a post. Unfortunately homeowners association hoa fees paid on your personal residence are not deductible.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Year-round residency in your property means HOA fees are not deductible. Generally HOA dues are not tax deductible if you use your property as a home year-round.

If you purchase property as your primary residence. Are homeowners association fees tax deductible. There are many costs with homeownership that are tax-deductible such as your mortgage interest.

However there are special cases as you now know. However since it is not subject to California corporation income tax it is also not taxable to the tax-exempt homeowners association. You may be wondering whether.

The IRS considers HOA fees as a rental expense which means you can write them off from your. The IRS considers HOA fees as a rental expense which means you can write them off from your. But there are some exceptions.

Filing your taxes can be financially stressful. 60 Percent Test Sixty percent. Are hoa fees tax deductible in california Monday March 7 2022 Edit Common deductions include money spent on mortgage interest repairs and maintenance insurance.

Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

HOA fees on personal residence - not deductible.

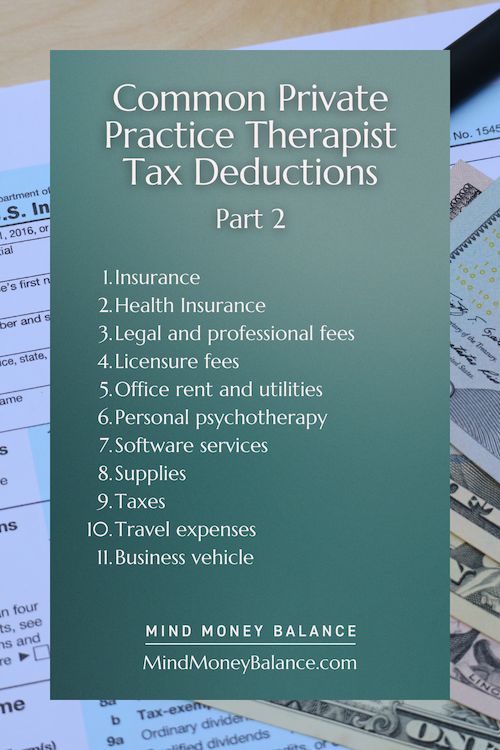

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Legal Expenses Tax Deductible For Your Business Boyer Law Blog

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Clark Simson Miller

31 Tax Deductions Real Estate Investors Need To Know About Mynd Management

Is A Tax Preparer Liable For Mistakes

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible In California Hvac Buzz

What S Tax Deductible When I Sell A House Upside Realty

Are Hoa Fees Tax Deductible Experian

Are Hoa Fees Tax Deductible In California Hvac Buzz

Are Landscaping Costs Tax Deductible

How Much Tax Do You Pay When You Sell Your House In California Property Escape

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)